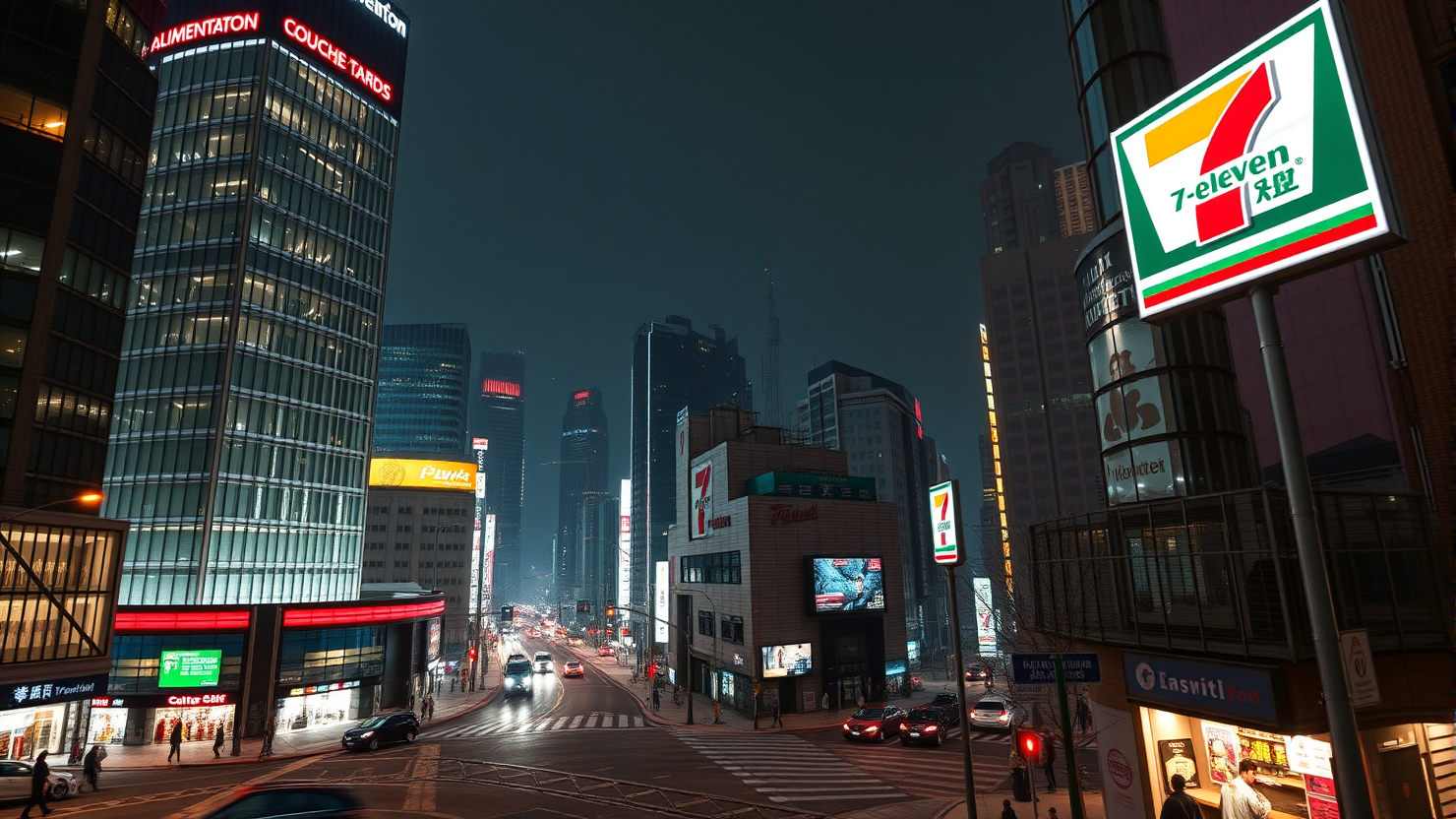

Canadian Retail Giant Abandons $47 Billion Takeover Bid for 7-Eleven Corporation

In a noteworthy development, Canadian retail giant Alimentation Couche-Tard has withdrawn its $47 billion takeover proposal for Seven & i Holdings, citing an absence of constructive dialogue and engagement from the Japanese retail conglomerate. The proposed acquisition, which would have marked the largest foreign acquisition of a Japanese company, aimed to create a global leader in the convenience store sector by merging Couche-Tard’s Circle K operations with Seven & i Holdings, the parent company of 7-Eleven.

In a letter addressed to its board of directors, Couche-Tard expressed frustration at the lack of sincere engagement from Seven & i, alleging a calculated strategy of obfuscation and delay detrimental to both parties. Seven & i responded, stating that while they were disappointed by Couche-Tard’s decision and disputed numerous mischaracterizations, they were not surprised.

The withdrawal comes at a time when corporate Japan’s openness to foreign takeovers is under scrutiny, following the successful $14.9 billion acquisition of US Steel by Nippon Steel. Seven & i shares fell 9% in morning trading on the Tokyo Stock Exchange following the announcement.

Manoj Jain, co-founder and co-CIO of Hong Kong-based Maso Capital, expressed disappointment at what appeared to be a lack of willingness to engage from Seven & i. However, he believed there was significant value to be realized in a combination and had previously expressed this view to the management and the board.

Negotiations between the two companies began when Couche-Tard increased its offer to approximately $47 billion last year and offered further increases if Seven & i cooperated and disclosed more financial information. The companies were also working on a store sale plan to ease regulatory hurdles.

However, progress seemed to slow after a white-knight bid from Seven & i’s founding Ito family failed to secure financing. Couche-Tard reportedly sought discussions with the family but found them unwilling to engage. The companies signed a non-disclosure agreement (NDA), but due diligence was limited, according to Couche-Tard.

Couche-Tard believed a full combination of the two companies would maximize value for shareholders but also explored alternative strategies. They proposed acquiring all of Seven & i’s business outside of Japan and 40% of the business in Japan, where convenience stores play a crucial role during natural disasters. However, such a deal “would not deliver the significant premium that was offered to your shareholders in our transaction proposals,” the letter stated.

Seven & i countered with a proposal to sell its international business to Couche-Tard in exchange for a stake in the Canadian retailer, but this offer did not meet the premium proposed by Couche-Tard. Seven & i, under the leadership of its first foreign CEO Stephen Dacus since May, has been under pressure to improve earnings and demonstrate independent growth.

The company has announced a share buyback, is selling off non-core assets, and plans to list its North American convenience store business. An investor in Seven & i, who wished to remain anonymous, commented that the prolonged negotiation process allowed Seven & i to avoid being bought out. Given the length of Couche-Tard’s negotiations, it is uncertain whether another bid will be forthcoming.