Jeh Aerospace Secures $11 Million Investment for Expanding Commercial Aircraft Supply Chain in India

In the rapidly evolving commercial aircraft sector, Indian startup Jeh Aerospace, founded by Vishal Sanghavi and Venkatesh Mudragalla, seeks to address the growing production bottleneck through a focus on scaling the production of metallic components for aero engines and aerostructures.

With almost two decades of experience at Tata Group, where they worked on projects with global aerospace industry leaders such as Boeing, Sikorsky, Lockheed Martin, and General Electric, Sanghavi and Mudragalla are now leveraging an $11 million Series A investment to tackle global supply chain challenges. They sell the produced components to U.S.-based Tier 1 suppliers who collaborate with major aircraft manufacturers like Airbus and Boeing.

The founders aim not only to alleviate supply chain bottlenecks but also to establish India as a significant player in aerospace component manufacturing. Sanghavi, who is also the CEO of Jeh Aerospace, emphasizes that their goal at Tata was to unlock India’s potential for large Original Equipment Manufacturers (OEMs), while Jeh Aerospace aims to do the same for Tier 1 and Tier 2 manufacturers in the supply chain.

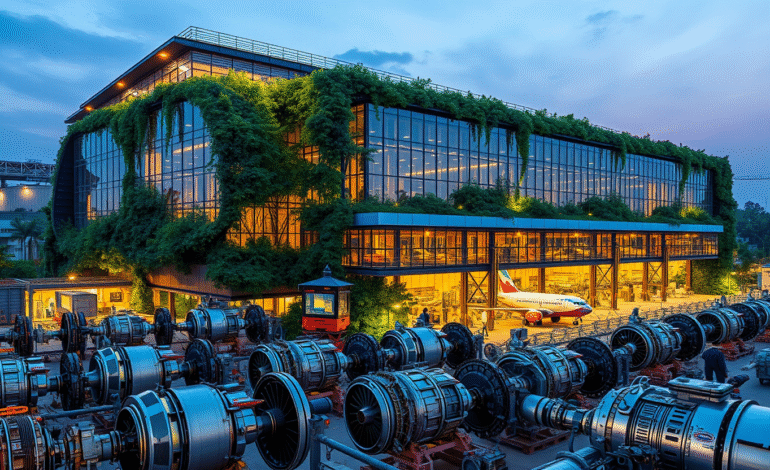

Headquartered in Atlanta to better serve its U.S. customer base, Jeh Aerospace operates a 60,000-square-foot software-based precision manufacturing facility in Hyderabad, India. The three-year-old startup combines precision machinery, robotics, and Internet of Things (IoT) devices to reduce product introduction lead times from the industry’s traditional 15-week timeline to just 15 days.

Jeh Aerospace’s software-defined manufacturing approach brings predictability and dynamic scheduling, enabling consistent supply without compromising quality. The company’s innovative strategy has attracted interest from venture capitalists and strategic investors, as evidenced by the Series A round led by Elevation Capital and participation from General Catalyst.

The rebound in global air traffic demand, as reported by the International Air Transport Association, has spurred airlines to expand their fleets despite talent and production bottlenecks. Tier 1 suppliers are facing extended lead times due to this surge, according to reports from Deloitte and McKinsey, with the commercial aircraft backlog reaching a record nearly 15,700 units.

Jeh Aerospace’s founders believe that technology-driven scaling of production for metallic components will help resolve these bottlenecks. This philosophy has shaped the company’s approach to building its workforce, advisory team, and business model. Instead of working directly with OEMs like Airbus and Boeing, Jeh Aerospace focuses on Tier 1 and Tier 2 manufacturers, which make up 60% to 70% of aircraft.

The startup currently has half a dozen paying customers, including GS Precision from Vermont and RH Aero headquartered in Ohio. Each customer is considered a high-value, high-annual recurring revenue (ARR) client with the potential to become a significant account within the next one to two years.

Jeh Aerospace has also assembled an advisory team with strong ties to commercial aircraft OEMs. The startup’s early advisors and backers include former Boeing India President Pratyush (Prat) Kumar and former Airbus India CEO and Managing Director Dwaraka Srinivasan.

In a short span, Jeh Aerospace has made significant strides in manufacturing and financial performance. Since its $2.75 million seed round in January last year, the startup claims to have delivered over 100,000 flight-critical components and tools on time. The company has also established a machine capacity exceeding 250,000 hours annually.

In the last financial year, Jeh Aerospace reached $6 million in annualized recurring revenue (ARR) and achieved profitability after taxes. For the current year, the startup projects a 3x to 4x increase in its ARR and boasts an order book worth $100 million.

The new $11 million in capital will be used to scale manufacturing and inspection capabilities by investing in next-generation digital production technologies, according to Sanghavi. The co-founders envision bringing more local manufacturing to India, further establishing the country’s position on the global aerospace map, similar to its emergence as a hub for iPhone production.

India already plays a growing role in aerospace manufacturing, with Airbus sourcing $1.4 billion worth of components annually from the country and aiming for $2 billion by 2030. Boeing plans a $1.3 billion annual spend and announced its intention to invest $200 million in a new engineering and technology center in Bengaluru in 2023. Despite these efforts, India has yet to achieve large-scale success in aerospace component manufacturing—a gap that companies like Jeh Aerospace aim to fill.

Though few Indian startups operate in aerospace component manufacturing, the sector includes players like JJG Aero, which appears to be a peer to Jeh Aerospace based on industry positioning. Sanghavi declined to comment specifically on JJG, noting that his startup sees its primary competition among U.S.-based tier-2 suppliers.