Unveiling the Unspoken Truth: Big Tech Pursues Nuclear-Powered AI – Hidden Facts Revealed

In recent years, nuclear power has emerged as a subject of renewed interest and discussion, positioning itself as a potential means to support energy-intensive artificial intelligence (AI) technology without causing detrimental environmental impacts or exorbitant increases in electricity costs. This resurgence has prompted tech companies to invest in expanding their reactor capacities, with the ultimate goal of securing a significant share of data center power and advancing their AI ambitions. However, this endeavor is not without challenges.

In 2027, Microsoft announced plans to revive Pennsylvania’s Three Mile Island nuclear power plant, which had been idled nearly half a century following an infamous partial meltdown in 1979. The company aims to leverage nuclear energy to establish “a decarbonized grid for our company, our customers, and the world.” Meanwhile, Meta intends to reactivate an abandoned Illinois reactor, while both Amazon and Google have ventured into new reactor technology development.

The Trump administration has issued executive orders promoting the nuclear industry, with Westinghouse announcing the construction of 10 new reactors in the United States, set to commence in 2030. However, it is worth noting that Westinghouse’s last reactors in Georgia faced significant challenges, including a seven-year delay, an $18 billion cost overrun, and bankruptcy for the company. In this latest undertaking, Westinghouse intends to employ Google’s AI products to expedite project development.

To gauge the feasibility of these ambitious plans, we consulted with several nuclear power experts who highlighted numerous hurdles to enhancing America’s nuclear capabilities, including exorbitant costs and extended construction timelines. Additionally, there is the potential for public apprehension regarding a Chernobyl-like incident occurring in their vicinity. The success of these efforts largely rests on small modular reactors (SMRs), a technology still under development and yet to be proven at scale.

To meet the demands of powering all data centers with nuclear energy, substantial capacity increases will be required beyond what is currently available or planned. Nuclear energy’s steady, consistent supply aligns well with AI models, which users expect to utilize for a variety of applications around the clock. However, generating meaningful quantities of nuclear power presents a formidable challenge.

According to a Goldman Sachs analysis, Big Tech companies would need 85 to 90 gigawatts (GW) of new nuclear capacity to power their AI data centers, but only 10% of that will be available by 2030. Meta is soliciting proposals for projects capable of supplying between 1 and 4 GW, accounting for less than 0.05% of Goldman Sachs’ estimated need.

“Nuclear energy is a realistic and well-suited option for data centers—the issue is timing,” notes Gary Cunningham, director of market research at Tradition Energy, an energy procurement and sustainability solutions advisor. “New nuclear would take years to deploy.”

Mark Gribbin, chief legislative analyst at the Joint Legislative Audit and Review Commission, concurs with this assessment. “Nuclear is a realistic solution in the long term, but it won’t solve the current and near-term energy demand crunch,” he says.

Gribbin oversaw a report on data center demands in Northern Virginia—a region home to more such centers than any other in the world. Residents in this area could see their electricity bills increase by $14 to $37 monthly by 2040 (adjusted for inflation), primarily due to the surge in data center demand, Gribbin’s team found. The costs associated with constructing new grid infrastructure are typically passed onto customers, as they would be with any other large-scale project, including wind and solar installations.

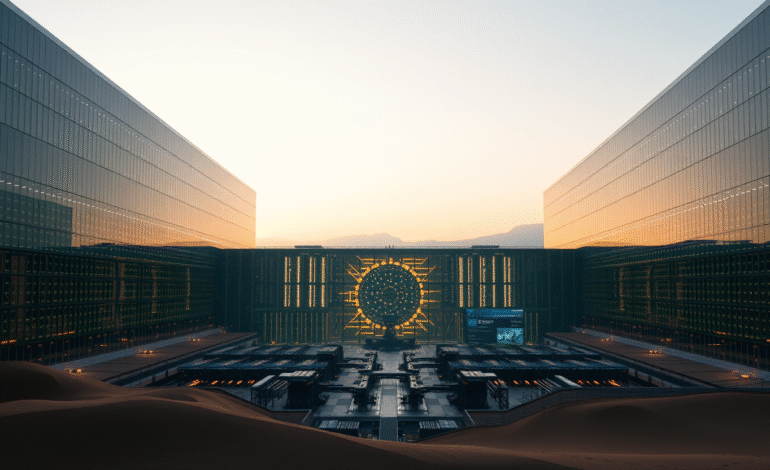

“Modern data centers are as large as a stadium,” Gribbin explains. Mark Zuckerberg, Meta’s CEO, envisions centers that could cover considerable portions of urban areas like Manhattan.

Meta’s Illinois reactor, operated by Constellation Energy, will feed power directly into the local energy grid managed by the utility, providing support for the company’s regional operations.

The safety of these older reactors is a concern that has not been publicly addressed by any of the involved tech companies. The 2011 disaster at Japan’s Fukushima plant, caused by a tsunami, renewed concerns about nuclear power safety after decades of inactivity (following the Chernobyl disaster in 1986). Although it is anticipated that new plants will feature improved alarm detection and auto-shutoff systems, it remains questionable whether local communities would embrace nuclear facilities in their neighborhoods. Concerns regarding radiation exposure in the event of an accident persist, as do potential health consequences such as cancer (according to the US Environmental Protection Agency). However, a decade after Fukushima, the UN found no statistically significant correlation between the disaster and cancer rates.

Small towns across the United States have already voiced opposition to data centers located too close to their homes. One Virginia community has endured persistent noise pollution from an Amazon data center, while Meta’s Georgia facility reportedly consumed large quantities of water, affecting local tap supplies (New York Times).

In Virginia, “we already face local-level community opposition to solar and gas facilities,” Gribbin notes. “I expect you’d see the same level of local opposition for proposed new nuclear facilities, especially if the facility is located away from one of the state’s two existing nuclear plants.”

The World Nuclear Association asserts that every industry experiences accidents, with nuclear power having experienced relatively few, given their high-profile nature. “The evidence over six decades shows that nuclear power is a safe means of generating electricity,” the pro-nuclear organization states. “The risk of accidents in nuclear power plants is low and declining.”

Technological advancements are also essential to expanding the role of nuclear energy. The reactors at Three Mile Island and Meta’s Illinois plant are antiquated, characterized by their large gray smokestacks emitting steam across the landscape. Experts predict that these types of reactors will not form the foundation of a nuclear-rich future.

Instead, small modular reactors (SMRs) are poised to become the new frontier in nuclear energy. Idaho National Laboratory describes SMRs as ranging from one-tenth to one-fourth the size of legacy reactors, making them easier to manufacture and deploy across various grid locations.

“There are numerous companies attempting to capitalize on the ‘build new nuke’ market to attract investors and government funding,” Cunningham notes. “The most likely candidates will not be the same technologies as legacy reactors but rather SMRs.”

Amazon and Google’s nuclear plans both focus on SMRs, not legacy reactors. Google claims its agreement represents the “world’s first corporate purchase of nuclear energy from multiple small modular reactors.” The company intends to support the manufacturer, Kairos Power, to ensure that its first SMR comes online by 2030, with subsequent reactor deployments scheduled for 2035.

However, it remains uncertain whether SMRs will ever become a reality. Some experts recommend investing in other “proven energy sources,” such as wind, solar, geothermal, and battery storage, suggesting that nuclear power—particularly SMRs—may prove economically unfeasible. If this comes to pass, investments in the sector could ultimately be deemed a waste.

As we evaluate the potential for nuclear energy, it is worth acknowledging Europe’s success in integrating it into their electrical grid. Approximately 65% of France’s electricity originates from nuclear power, compared to 19% in the United States (US Energy Information Administration). Britain’s Rolls-Royce is developing next-generation SMRs and currently leads the way in the technology. If the company succeeds, the US could potentially utilize its products.

Whether any country can achieve a fully nuclear grid remains to be seen. To power US data centers with this technology would require a large-scale, coordinated deployment of (currently nonexistent) SMRs across various grid locations—a feat requiring significant funding, the use of legacy reactors in the interim (hopefully without any incidents), and a considerable amount of luck. In the meantime, the rapid expansion of data centers is expected to create discomfort for local residents, as well as environmental challenges. One must question whether this undertaking is worthwhile solely to facilitate interaction with an AI chatbot.